Happy new year brexit voters

The #brexit Hashtag I follow religiously on twitter because I am interested in economy and exasperated with this idea that somehow the six months that followed the UK’s disastrous vote to leave the EU somehow proved us brexit doomsayers wrong.

What will 2017 bring? I’d like to think prosperity and happiness, but I am afraid

‘We ain’t seen nothing yet’ in terms of the economic self harm the UK is set to embark on.

It really is incredible that you have to point out to these die hard Brexit now! shouters, that the UK hasn’t left the EU, until Article 50 of the Lisbon treaty is actually invoked.

The UK Prime Minister has predicted this would take place no later than March 31st 2017. But even then, there are multiple legal and constitutional hurdles to overcome, which will add at least another two years before a brexit will effectively kick in.

Meanwhile any economic good news reported by the Media can just as easily be ascribed to the fact that the UK hasn’t actually left the EU yet, hence is still benefitting from full single market access, EU negotiated trade deals etc. and the market clout of being in the largest integrated economic area in the world.

What is clear to leavers and remainers alike is that the continued uncertainty around what kind of brexit we might actually get is quite accurately reflected in the abysmal performance of the UK Pound Stirling in the exchange markets. The almost cliff edge drop, the day after the vote, is kind of hard to ignore, as is every downward jitter every time a cabinet minister opens his mouth about leaving the Single Market with a ‘Hard Brexit’.

This is followed by a small release of pressure on the pound each time a suggestion is leaked by the ministry of Brexit, that the UK might actually pay to stay in Single Market and EU Customs Union in a kind of Norway or Swiss style EEA membership.

Meanwhile we have had only one meaningful report on the impact of the June leave vote on the UK’s Gross Domestic Product by the UK’s independent Office of National Statistics (ONS). This report was published 27 October 2016 and covers Q3 (July-August-September) with another one due on Q4 mid January 2017. Any other glowing economic news on the impact of brexit by Eurosceptic papers like the Telegraph or the Daily Express must be taken with a huge pinch of salt.

So while the UK economy seems sofar to have escaped a disastrous impact of the brexit vote, most economists agree that this is most likely just a stay of execution till Article 50 actually triggers an actual leaving of the European Economic Area and associated unfettered Single Market access.

Meanwhile here is an actual block quote from the Q3 2016 ONS GDP report:

“This is the first release of GDP covering a full quarter of data following the EU referendum. The pattern of growth continues to be broadly unaffected following the EU referendum with a strong performance in the services industries offsetting falls in other industrial groups.”

“In Quarter 3 2016, the services industries increased by 0.8%. In contrast, output decreased in the other 3 main industrial groups with construction decreasing by 1.4%, agriculture decreasing by 0.7% and production decreasing by 0.4%, within which manufacturing decreased by 1.0%.”

For me what stands out is the continued decline of the UK Manufacturing sector, while some Brexit shouters cling on to the idea that it is on some sort of 25 year high!

Also the positive impact on UK exports from a devalued pound remains elusive. The UK still trades at a loss with a negative balance of trade in goods balanced by a positive trade in ‘Services’, the sector of the UK economy most under threat by a brexit. And this “we’ll trade globally” nonsense? In October also trade with non-EU countries went into the red. Not a thing you will hear many kippers shout about. Here’s a quote from the latest report from HM Revenue and Customs:

“In Non-EU trade the UK was a net importer this month,

with imports exceeding exports by £4.9 billion.”

They continue with their “They’ll trade’ nonsense regurgitated day in day out by kippers and eurosceptic ‘nice but dim’ Tories in their Closed Ideology Echo Chamber with no-one there seriously challenging them. What is worse, lazy journalists like Andrew Marr often start a TV interview with pro -EU politicians by repeating and hence re-enforcing these EU and UK fake economic ‘good news’ stories, because they are too lazy to check on their veracity.

Meanwhile the Independent warns us that brexit will send UK tumbling down world economic league table with both France and India overtaking Great Britain.

“Covering 188 countries the Cebr’s World League Table forecasts that the UK will have the seventh largest economy between 2017 and 2025, before slipping back to eighth place in 2030.”

The most often repeated brexit good news myth is the continuing rise of the FTSE 100, an index of the UK stock market. Even the Express warns their gullible readers that this is mainly an effect of the falling Pound:

“The rallies have been driven by a fall in the pound, which is sitting at 31-year lows of 1.145 against the dollar, and 1.277 – its lowest level in three years against – the euro, boosting the earning potential of UK-listed firms with overseas earnings.

Sterling’s fall also makes stocks cheaper for overseas investors to buy stocks.”

Very helpfully the ft.com web site allows the reader to view the City of London stock market performance over the six month since the referendum in US dollars.

I am happy to reproduce a screenshot from Jan 2, 2017 here:

Two years ago I published a blog post on a bunch of pro-brexit economic mantras that do not stand up to any kind of scrutiny and defy common sense. Today I have no qualms about literally cutting and pasting the same mantras with one or two new insights.

I think in today’s blog I have dispelled three new (post brexit vote) myths

- The UK Stockmarket is fully recovered and in fact at an all time high since brexit

( it is actually 5% down since Britain voted to leave the EU) - UK Manufacturing is at a 25 year high and our exports are benefitting from a devalued Pound Sterling.

(In fact even with non-EU countries our imports now exceed UK exports) - We are such an economic power house countries are queuing up to sign trade deals with UK ( in fact we slipped from fifth to seventh in the world economic rankings)

I repeat my challenge to ‘Leavers’ to debunk anything I say on the UK economy with their own rosy version of what actually is happening after the June referendum vote. I repeat below nine myths already debunked 2 years ago, because they are worth repeating and still stand today:

If you are already familiar with this post I suggest you stop reading at this point.

- In the EU we are shackled to a moribund corpse in terminal decline

- EU red tape is holding the UK back. 90% of UK businesess don’t need regulation

- The percentage of global Gross Domestic Product (GDP) of the EU is shrinking

- Look at all these developing countries showing 6-8% annual growth, we’re missing out not trading with them

- After #brexit we will be free to trade with the world

- We should have never deserted our friends in the Commonwealth

- Our trade with the EU is massively distorted by the Rotterdam-Antwerp effect

- If only we could make our own trade deals, sit at the top of the WTO table again

- The EU will still trade with us after brexit because we buy more from them, than they from us, we are in a position of power.

EU a basket case in terminal decline?

Before working our way through the list of above fallacies let me remind the reader that, whatever its sins, with its 500 million consumers and $18-trillion GDP, the European Union is still the world’s single largest integrated economic area, and it’s right on the UK’s doorstep, not half way around the globe! Even if since the 2008 financial crisis, EU growth has hovered just above freezing point these last few years, 0.4% growth of a $18-trillion GDP is still an awfully big number! If economic genius @RedHotSquirrel, aka ukip’s Robert Kimbell quotes, as he likes to do ad nauseam, yet another random African country with five or six percent growth, so what? Basically it means, that if EU growth remained stagnant over the same period period, it would take Africa 50 years growing at 5% just to catch up with the EU!

We all know that growth usually happens in spurts, in economic cycles that come and go, taking the economy up and then down again. There are no indicators that the EU economies will actually seriously contract again in the near future. The latest Quantitative Easing measures announced by the ECB might even get the EU’s sluggish economies moving again? It seemed to have done the trick in the USA. In any case, 500 M. consumers in the EU will still eat, go on holidays and replace household goods. Buy things made in Britain! They are not ‘dead’ by any means of ukip’s imagination or wishful thinking!

A mathematical certainty: Global GDP cannot rise above 100%

Incorrigible Eurosceptic Daniel Hannan MEP likes to bang on about the fact that Europe’s percentage of global GDP is in long term decline. He loves to say:

“In the year we joined, western Europe accounted for 38 per cent of world GDP. Today it’s 24 per cent, and in 2020 it will be 15 per cent. Far from joining a prosperous market, we shackled ourselves to a corpse.”

Am I the only person to see the fallacy of this argument? Is this why both Hannan and Kimbell immediately blocked me on twitter, so I can’t prick through their vacuous arguments at will? Of course it is either terribly misleading or incredibly stupid to make such outrageous propaganda claims. With the best will in the world, all its nations’ GDP percentages always will add up to the same 100%. For most of the last century Europe and North America together have laid claim to about half of the world’s resources and squandered together 50% of its wealth, as commonly expressed in terms of global GDP. Then emerged, what we like to call the developing economies of the BRIC countries, Brazil, Russia, India and China, which are all at a similar stage of newly advanced economic development. Together they are now good for about 30% of global GDP. Do you think that an intelligent Oxford educated man like Hannan does not know, that it is a mathematical certainty, that as these countries take their share of global resources and output, the percentages representing the USA and EU must necessarily fall? Remember he is not some silly contestant in a TV show promising to give 110% to please, please stay in ‘Britain’s got talent’ or the X-factor. He is a devious #brexit demagogue of the worst kind, because unlike his ukip adulators, you sense he is kinda smart! He knows full well, that if you bandy about economic half truths like that, some of it will stick in the minds of UKIP and Tory Eurosceptic simpletons. The fact of the matter is: Europe can have growth in absolute terms, while declining in relative terms. That is not a bad sign my kipper friends, it’s a good sign of rebalancing global economies and continuing world progress and harmonisation. We in the West have had it our way far too long, while whole continents suffered in poverty to feed our greed. The next time a kipper tells you the EU’s economy is shrinking remind them only Finland and Greece still have that problem. The rest are growing fine, just not as fast as some developing nations playing catch-up. Spain actually grew faster than the UK in 2015, but kippers prefer to point their little finger at Greece.

We abandoned our friends in the Commonwealth

The next thing your typical ukip brexit activist likes to tweet on and on about is how well the old British Commonwealth is doing, and how we should have never abandoned them in favour of the EU Common Market. This is another favorite Hannan propaganda line.

Far-flung Commonwealth nations would make a far more natural trade bloc than the EU. It never made much sense to abandon a diverse market, which comprised agricultural, industrial and service economies, in favour of a union of similar Western European states.

That is absolute bollocks Daniel. That line may have made sense for the British Empire, when you could send in the gun boats and enforce such a colonial trade policy. Didn’t you study modern history in Oxford Daniel? Forgotten the image of Gandhi spinning his own yarn as a peaceful protest against UK manufactured goods? Your idea of trade is not how modern nations operate today. I owe you references, but I have been taught in economics that nearby nations of a similar wealth and stage of economic development benefit most from trade. Not trade that exploits their natural resources and dumps unwanted manufactured goods on ex-colonies. We are talking about a ‘mutual beneficial trade’ with the EU, because the consumers in EU countries like the additional choice that such trade offers. An example of consumer choice is a Frenchman ‘sick’ of all the Renaults, Citroens and Peugeots in his street and instead would like to make a statement driving a sporty UK Nissan, a cool Mini or even a ‘posh’ Range Rover. This is a win-win two way kind of trade, not the pillaging of the colonies you Hannan seem to be lusting after. But I am sure that kind of neo-colonial ‘Britannia rules the waves again’ talk goes down a lot better with your ukip followers. One kipper @leslieappleyard was so desperate to prove your point, that he found a quote for shipping a container to Auckland New Zealand that was two hundred pounds cheaper than sending the same size to Athens. He made a big thing of it on twitter:

What Leslie and most would be world traders don’t realise is that if you are running a trade deficit with most of the world’s economies, that manifests itself in a lot of empty return containers making their way back to Europe, China, or wherever. Of course shipping lines will do special deals to ensure some of those containers contain actual goods produced in the UK, rather than remain empty. Just like RyanAir offers you heavily discounted midweek flights to the continent, rather than flying empty planes back and forth. Common sense should tell you that the closer your market, the cheaper your transport costs. But when it comes to brexit, common sense is the first victim in a kipper’s mind. So Auckland must be closer than Athens, and because in Malawi they enjoyed 8% growth from nothing, with their per capita GDP of less than a thousand bucks per year, in some kipper’s eyes they are now candidates to sell all those unsold Sunderland Nissans to after brexit? Who are they fooling in their ukip bubble?

If you don’t believe me here is an Australian Wayne Cole making the point U.K. trade could face cold reception from former colonies.

“For all the shared history, Britain is a fading presence in its former colonies. Australia’s Prime Minister is an avowed republican. New Zealand is voting on whether to remake its flag without a Union Flag.”

Don’t clutch at the Rotterdam-Antwerp effect my kipper friends

Whenever you tell a kipper that roughly half of the UK’s trade is with its EU neighbours, the scripted ukip answer is that EU trade figures are just another establishment lie. They’ll have picked up from the Daily-Express or Dan Hannan, that really our trade with the ‘English speaking nations’ of this world is much bigger than official ONS figures for trade with Europe. (Note that conveniently, in the trade definitions they use, now the Commonwealth and the USA are clubbed together for effect. Even ex-colony Hong Kong and other city states that speak a few word of English are thrown in). The debating line will be that the true size of EU trade is overblown because of so many of UK exports are shipped through the nearby ports of Rotterdam and Antwerp, therefor are classed as EU exports, when in reality their end destination is elsewhere in the rest of the world. You’d think that the few kippers that can count, would find it a tad strange that even with Holland the UK cannot seem to manage a positive trade balance? I refer of course to all those exports destined for the Commonwealth wrongly attributed to the Netherlands or Belgium and hence to the EU? The problem is that few kippers have properly read, let alone understood the Civitas report that the Express likes to misquote in its many anti-EU propaganda drives. Civitas themselves warn in their conclusions not to “overestimate the Rotterdam-Antwerp effect” and that ” the overall trade distortion of the Rotterdam-Antwerp effect is not great”. Pascal in his excellent “EU-debate” blog demolishes the trade distortion argument even further:

“I can even go further in my proof that it’s nothing to do with EU regulation. The fact is that the same thing happens whoever we trade with. Therefore in the same way that UK-EU trade is inflated, so is UK-US trade. When we export oil to Canada and that oil stops at a US port before then going on to Canada, can you guess who we say we’ve traded with? Yep, the US. This is particularly important as the US is our next biggest trading partner and so it is good to ensure the Eurosceptics don’t also use inflated figures when talking about how much we trade with other countries such as the US” .

Most countries of the EU have comparable wealth to the UK. Some actually a lot more! They generally make and buy the same sort of things the UK does. Often we make things together like Airbus, remember them? The great thing about our EU neighbours is, that like us, they appreciate choice in what and from whom they buy. EU industries’ value chains today are more and more interlinked. Much more so than with those in the rest of the world. This is only possible because it is just a short stretch across the channel, with most EU export destinations in an easy one day’s drive reach for roll on roll off containers (the kind with trucks attached).

Data suggests that UK employment is very closely tied to EU partners via value-chains in a way that non-EU export jobs simply are not. This is no doubt in part driven by the simple fact that EU is so close, but it is also hard to believe that this is not driven by regulatory commonalities in the single market. These interwoven relationships along the value chain are in stark contrast to the kind of ‘ship and forget’ trade that appears more characteristic of non-EU trade”

The interwoven EU value chain rebuke can also be used to argue how many UK jobs are dependent on trade with the EU, although how many exactly is anyone’s guess.

Rather than worrying about signing a Free Trade Deal with the EU after a possible brexit Eurosceptics should do well to worry about the abysmal state of UK manufacturing.

Britain’s manufacturing base is one of the worst performing of the world’s developed countries, a recent shock report revealed. It is not just the handicap of exporting against an over valued pound. Brexit might bring that UK vanity project back to earth soon, in the sense that Sterling is already crashing at the thought of it. It’s more the fact that successive Tory governments don’t seem to have an industrial policy to raise UK’s poor productivity levels e.g. by stimulating innovation in manufacturing. For them it’s just about the City of London, where all their Public School chums work. Same with Farage.

Who can afford the luxury cars the UK manufactures so well (apart from Chinese millionaires, Russian oligarchs and a few tin pot dictators)?

The EU per capita GDP is $35,000 instead of the Commonwealth’s $3,500. And that $3,500 average becomes a lot lower if we take the two richest Commonwealth nations Canada and Australia away from this figure. Go figure where the biggest market is for Jaguars, Bentleys, Rolls Royce? But also for more down to earth UK Nissans, Tiptree Marmalade, Cadbury chocolate bars, McVitie’s Hobnobs. Not in some village in rural Africa! Not in the tribe lands of Pakistan. The truth is trade with the Commonwealth was in long term decline long before Britain decided to join the Common Market. There is no marked dip in the graph around UK’s join date in 1973, just a continuation of a decline that set in shortly after WWII as the following graph clearly shows.

Out of the EU and into the world, an inconvenient reply

The next kipper argument goes that EU red tape is holding the UK back. Even if their own captain’s of industry actually say time and time that the amount of EU regulation is about right, and in any case a darned sight better than facing 28 sets of red tape and customs declarations as was the case before the Common Market created a customs union. The argument that just because a UK business doesn’t export to the EU it doesn’t need regulating is of course the biggest myth of them all. As if UK consumers don’t need protection. As if they’d put up with shoddy goods just because it has a label “Made in UK not for export to EU”. If anything UK consumers would run a mile from those products. I expanded on that subject in another blog post using Chinese Formula baby milk containing melamine as an example. No, EU standards will do nicely, even if only for consumption in the UK thank you very much Mr. Farage!

Germany and France face the same EU red tape as Britain yet outperform the UK when it comes to exports to China.

Lets take our place at the WTO top table again, but will we?

So what would happen after a brexit, that miraculously would set the UK free to ‘trade with the world again, according to ukip? First of all I would question the underlying assumption that the trade deals the EU makes for all of us are always skewed against the interests of the UK. We never see any proof when eurosceptics make those claims. Could the truth be far more inconvenient? Could it be that maybe, just maybe, Britain isn’t such a great trading nation in the first place? If I look at EU neighbour The Netherlands, this country earns almost 30% of its income from the export of goods and services. In 2012, the value of exports was 86.7% of the Netherlands’ GDP. The comparable figure for exports of goods and services (% of GDP) in the United Kingdom peaked at 32% in 2011, according to the World Bank. As a UK ex-pat living in France, you only have to try and get something delivered from back home, and you immediately run into a self defeating attitude, where British suppliers steadfastly refuse to deliver orders to the EU mainland, although no customs formalities are involved. The same for UK traders on eBay, they refuse to change their delivery default from ‘UK and Eire only’, as if it’s a chore to buy a few stamps for Europe along with 1st class stamps for UK customers? Yet these same small minded people will vote for UKIP and dream of Britain trading with the world after brexit? They think if they’d only take up their old membership of the World Trade Organisation(WTO) they would straight away sit right next to the EU at the top Table? Or is it more likely they would they sit in the main hall next to Norway, Iceland and Lichtenstein clutching a copy of flexcit Mr North? Remember these EEA countries follow EU rules, pay for the privilege, don’t vote for any of it.

If only the UK could make its own trade deals, sit at the top of the WTO table again?

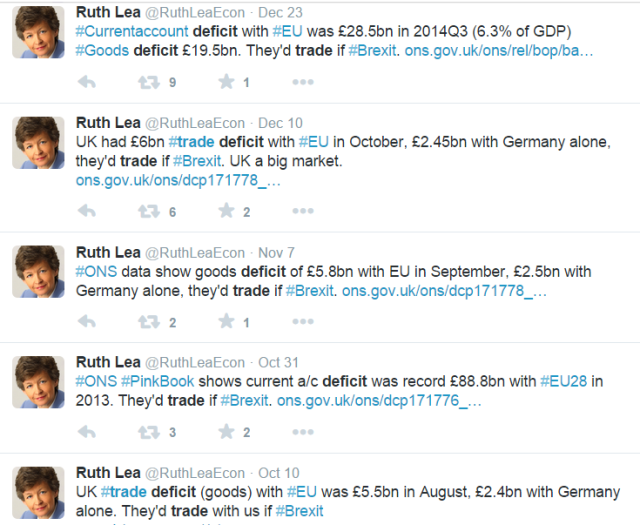

They’d trade if brexit ( or maybe we’ll be the next Greece?)

My final scorn is reserved for @RuthLeaEcon. Although not sure if she is a kipper or just Eurosceptic, she regularly tweets nonsense under the #brexit hashtag, while as a trained economist, she should know better. One of her favourite clichés goes as follows: “They’d trade if #Brexit.” Her reasoning, along with many kippers, seems to be that running a long term structural trade deficit with another country or trade block like the EU somehow makes that country beholden to you. Remember buying from abroad is easy. Getting them to return the favour is the hard bit. The UK should maybe start by making quality goods they actually want abroad, rather than thinking signing a piece of paper will do the trick as kippers suggest.

Well having studied a bit of economics myself, I find ‘They’d trade’ a bit hard to swallow. But kippers lap it up like my cat likes his morning milk. Common sense tells us that imports to a nation are like shopping to a family. Exports to a nation are like having an income to pay for the shopping bill. All families sometimes spend more than they make, but we also know that in the end it’s wise to balance our books and not go further and further into debt. At a macroeconomic level a trade deficit can in the short-term sometimes be offset by capital flows, but there is a big big caveat here long term, which every basic book on economics will tell you. And it’s not good news whatever Ruth and her kipper friends try to tell you. I recently came across another blog from Henning Meyer who makes mince meat from the argument that the EU has so much more to lose. Using data from the MIT Observatory of Economic Complexity he points out “The EU doesn’t exist as one unit as it is a group of 27 countries. So the comparison is 1:27 and 27:1 – not 1:1

Some of those countries hardly sell anything to the UK but still will have a veto in any article 50 negotiations. Negotiations where UK is not at the table when they vote over any post brexit EU-UK trade deal.

“the rest of Europe sells us more stuff than we sell them and therefore they will give us a free trade deal as they don’t want to shoot themselves in the foot”. You can easily debunk this myth in 2-3 steps”

Henning’s arguments are well worth a read. I’ll just stick to my old economy text book:

A schoolbook text, why running a structural trade deficit for the UK economy is nothing for ukip to brag about, in the long run it will end in tears.

Conclusion

I hope I have debunked a few brexit economic half truths and fallacies. I know I will not get much of a reply here, because swiftly the kipper argument will change to the EU’s democratic deficit and hollow phrases like: “we never ware asked”, “we never got to vote on joining a political union” or “I don’t like it if 70% of our laws are made by nameless bureaucrats in Brussels”. They will throw quotes at you from Winston Churchill, which are totally doctored. Winston Churchill was a founding father of the EU and in his famous Zurich speech in 1946 very clearly said that sovereignty needs to be pooled sometimes, for greater effect. My ultimate answer to a kipper is that if you are that bothered where they make the rules on food labelling for a common market the UK joined after the first referendum in 1973, then maybe you have not got much of a life? Maybe you should get one? The principle of subsidiarity is now well ensconced in the Lisbon treaty and this political union will never happen. We need to take this with a pinch of salt. None of the EU member states want this ‘ever closer union’. None of them like red tape more than the UK. But the UK has to remain and be engaged in the EU decision making process to make sure talk of it doesn’t rear its head again. We now live in a globalised world and the challenges we face are better faced together in a United Europe. Not by scarping from the sidelines, while dreaming of an empire lost a long time ago.

Theresa May should think twice before invoking Article 50 in March. The tide against brexit has turned to such an extent there is no shame in this. The Referendum was made ‘Advisory only’ for a good reason by your trusted civil servant ‘Sir Humphrey’. He or the powers that be, gave you a way out of this madness that is Brexit and an opportunity for Britain to continue to play a role on the world stage from within a strong EU partnership.

28/01/2017 update. ONS has now published its second post brexit [vote] quarterly report.and the update is

“Following falls in Quarter 3 (July to Sept) 2016, construction and production provided negligible positive contributions to GDP growth in Quarter 4 2016.”

“UK GDP was estimated to have increased by 2.0% during 2016, slowing slightly from 2.2% in 2015 and from 3.1% in 2014.”

Pingback: Trade after Brexit: Better to sell where 90% of growth is or 90% of purchasing power is? Crisps anyone? | IdentitySpace